Harry analyzed the effective edge in 1952, and in 1958, Tobin added nonrisky ways to modern portfolio theory.

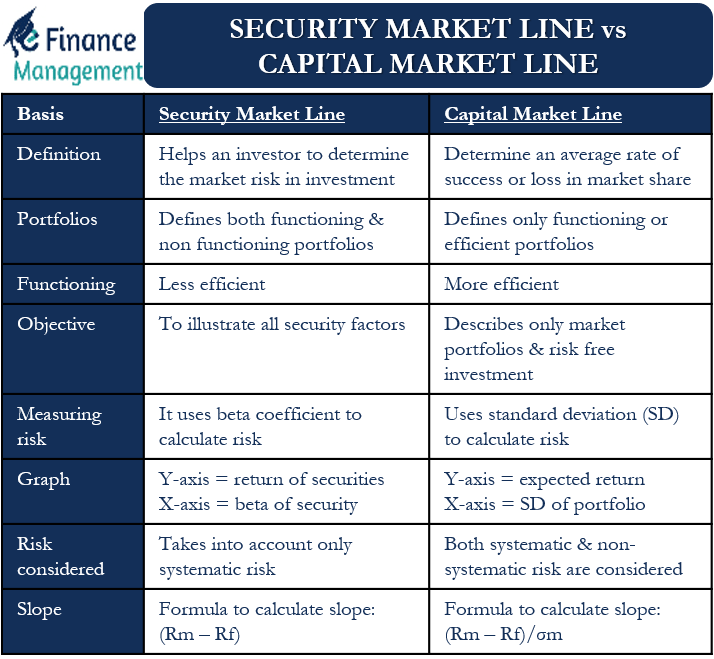

James Tobin and Harry Markowitz explored average deviation investigations. Tangency profile can be achieved when the mark of CML and frontier deflects. With the guidance of CAPM, dealers in the field will go for a spot on CML to get stability by trading non-risky shares as it will give a good return with minimal risks on them.ĬML is different compared to other famous efficient frontiers, as it consists of non-risky investment. CAPM is a philosophical idea, which provides a profile that excellently merges the risk-free rate of return and a general profile of dicey shares in the market. On the other hand, CAPM (Capital asset pricing model) characterizes the deals happening among risks and rebounds for the effective profile. CML tangent line is drawn from the point of the risk-free asset to the feasible region for risky assets and optimally combine risk and return.ĬML (capital market line) provides reports that excellently merge risks and rebounds. Are CML and SML (Security Market Line) similar? What is Capital Market Line?Ĭapital Market Line or CML is a tangent line representing the relationship between risk measured by standard deviation and return of the portfolio.

#Cal vs cml how to

How to Describe the Relation between CAL (Capital Allocation Line) and CML?.Why Is the CML (Capital Market Line) important?.Knowledge about CML(Capital Market Line).

0 kommentar(er)

0 kommentar(er)